Can retailers curb e-commerce’s carbon footprint?

The explosion of online shopping has a major effect on the ability of retailers to achieve their net-zero goals. What can retailers do?

Sam Oswald

Senior Engineer

Last updated: July 2023

E-commerce is constantly evolving to keep pace with consumers’ on-demand expectations. From groceries and gourmet meals to fashion and electronics, over the last few years, e-commerce deliveries have caused a sharp increase in urban logistic services.

In 2023, 82 per cent of Australian households made an online purchase and online spending increased to $63.8 billion from $17.3 billion in 20151.

For many retailers, the logistics supply chain makes up a large proportion of their carbon footprint. The demand for fast delivery and free returns makes it harder for retailers to decarbonise and meet their net zero targets. And the rise of ‘returns culture’ adds extra pressure on urban logistics. Approximately 30% of all online purchases are returned, with 30 per cent of these not able to be resold2. Emitting millions of tonnes of CO2, impacting retailers’ margins and sending 2.5 million tonnes of waste to landfill each year3.

However, consumers are becoming more conscious of the impact of their purchasing decisions. This behavioural awareness is reflected in the growth of the electric vehicle market, increasing demand for recycled and second-hand products and a tendency towards buying locally.

This scenario poses an important question: do retailers continue to prioritise on-demand deliveries, or can they influence consumers to make sustainable choices?

Can retailers decarbonise logistics?

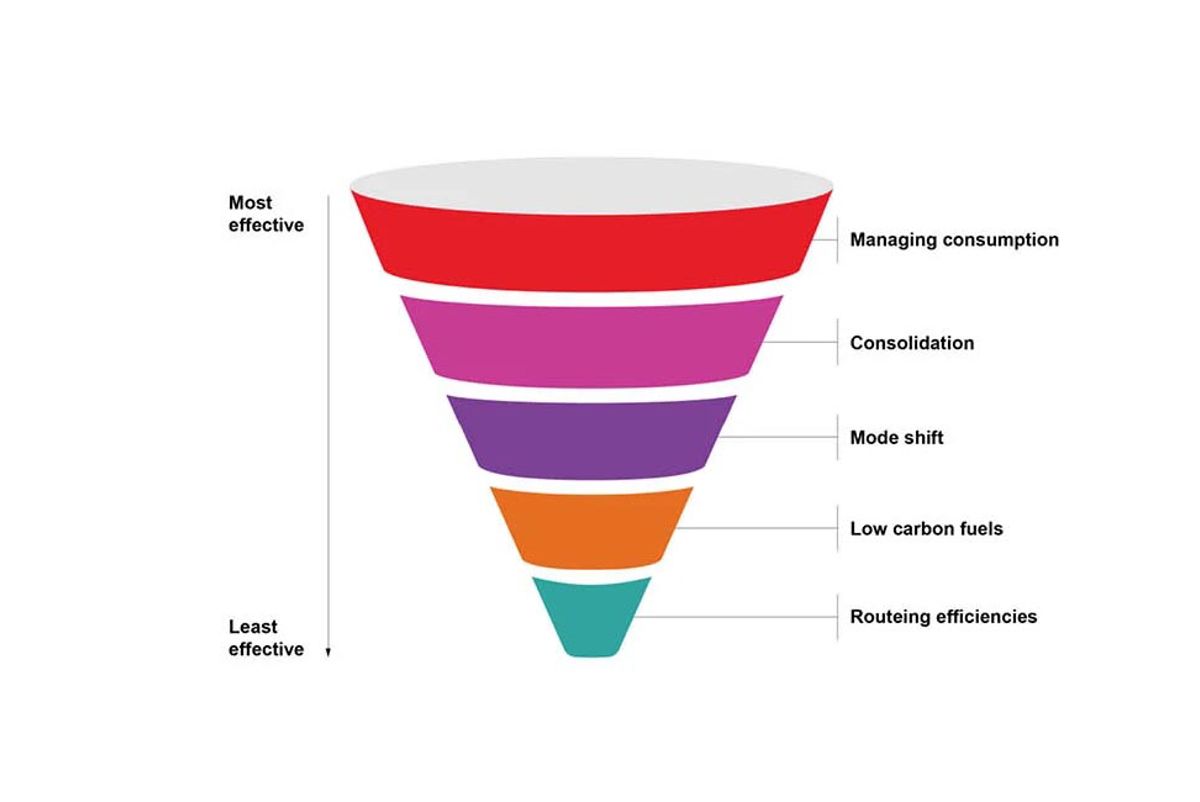

Retailers have an essential role to play in decarbonising urban logistics. By changing and decarbonising their operational model, retailers can reconfigure supply chains to support sustainable outcomes. To decarbonise urban logistics, retailers can use the following hierarchy of measures4, ranging from most to least effective.

Managing consumption: Influencing consumer purchasing patterns to be less immediate and more carbon conscious can reshape the logistics task and improve planning for other emissions-reducing measures. Retailers should also consider the impact of gift-with-purchase deliveries. Gifts incentivise purchases and add more goods movements from centralised locations, further increasing the carbon cost.

Consolidation: By pooling inventory, retailers can consolidate the point of sale and share assets and inventory between retailers. They can also increase vehicle loads and share carbon emissions between deliveries.

Mode shift: For many last-mile deliveries, from the retailer to the consumer’s doorstep, e-bikes or other micro mobility devices are a viable option. These also use less road space, can deliver faster and do not impact air quality.

Low-carbon fuels: Transitioning fleets to greener fuels, i.e., battery technology for smaller vehicles or liquid-based fuels such as biodiesel or hydrogen.

Routeing optimisation: Data can be analysed to avoid congestion, re-time deliveries, and upskill drivers to operate more fuel efficiently.

In 2023, 82 per cent of Australian households made an online purchase and online spending increased to $63.8 billion from $17.3 billion in 2015.

How can retailers influence consumer behaviour?

Influencing consumer behaviour is a complex task. By understanding human factors, retailers can craft measures and processes to adjust behaviour. Applying the hierarchy of controls, we can remove or reduce incentives that encourage ‘need-centric’ buying patterns.

Maintaining competitive advantage is key, so immediate deliveries and free returns cannot be eliminated. Instead, behaviour can be shaped using preventative solutions that aim to reduce the behaviour or mitigative solutions to reduce the impacts of the behavioural decision.

By applying these concepts, retailers have several levers to pull to shift consumer behaviour:

Preventative measures: Prompts, such as website pop-up windows, at the purchase stage can inform consumers of the carbon emissions generated by their order and returns. This can be paired with supply chain dashboards adding transparency to educate consumers. Prompts should be communicated in a tangible manner i.e., a number of trees cut down or a proportion of a flight between Sydney and Melbourne.

Mitigative measures: Premium surcharges for express and next-day delivery or ‘carbon-neutral’ deliveries. Surcharges can be used to purchase offsets to match emissions or implement improved sustainable logistics systems and processes.

Retailers must take consumers on their decarbonisation journey to ensure ongoing support and allow an iterative approach to shaping behaviour. Online platforms can allow for trials on smaller product lines, and advanced analytics can underpin future decisions.

Combining innovation with consumer education

Decarbonising urban logistics is a complex problem requiring nuanced and bespoke solutions for different organisations. Combining freight and logistics innovations with consumer prompting and education can establish a path towards net zero.

1 2023 Inside Australian Online Shopping

2 Online shopping returns are ending up in landfill, Online shopping returns in Australia can’t be put into inventory, so where do they go?

3 Free returns come with an environmental cost

4 Australian Retailers Association, Net Zero Essentials; Module 4: Low Carbon Logistics 2023